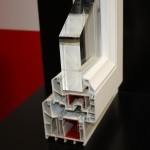

In 2013, the companies active on the Romanian PVC joinery market began their activity under better auspices, given the prospects of attracting European funds in order to support the national program for thermal rehabilitation of the existing buildings. Even though the project will not materialize in a complete way, through spending all amounts made available by the European Commission, this could be, at least, a welcomed psychological boost for this segment. There is no market analysis made in the present circumstances, regardless of the expertise of specialists who carry it or the data accuracy, which foreshadow the developments in the industry, not even on short term. Starting from this idea, the best approach is to research specific data - currently available - and to outline some plausible scenarios, within a limited rate of probability. According to figures provided by the National Institute for Statistics (INS), in the first nine months of the financial year 2012, the total value of imports of PVC systems stood on a slight downward trend and has decreased by less than 2% compared to 2011. Thus, the analyzed market appear to have stabilized somehow, yet at a very low rate. Also, the prospect of recovery is still quite far away, and even if resettlement opportunities in the local economy recession are low, a possible recovery process will take place after the revival of the construction segment, which in fact, has not yet begun. Taking into account that the local production can be estimated at a level of about 30% of all systems used to manufacture PVC windows (most important competitors holding extrusion units in Romania are represented by Gealan, Teraplast Extruplast and Ramplast), a simple estimation indicates that the local market value of PVC profiles is placed between 105 million Euro and 110 million Euro. This means that the total value of finished products (windows and doors) sold locally is estimated between 320 million Euro and 340 million Euro. All the data presented confirm the trend of stagnation, which can be interpreted in two different ways: one positive (given by the end of the decline phase) and one negative (consisting of the inability to resume growth in a hostile business environment, characterized by lack of financial resources). For further information and a detailed analysis of the current Fereastra issue, click here!

In 2013, the companies active on the Romanian PVC joinery market began their activity under better auspices, given the prospects of attracting European funds in order to support the national program for thermal rehabilitation of the existing buildings. Even though the project will not materialize in a complete way, through spending all amounts made available by the European Commission, this could be, at least, a welcomed psychological boost for this segment. There is no market analysis made in the present circumstances, regardless of the expertise of specialists who carry it or the data accuracy, which foreshadow the developments in the industry, not even on short term. Starting from this idea, the best approach is to research specific data - currently available - and to outline some plausible scenarios, within a limited rate of probability. According to figures provided by the National Institute for Statistics (INS), in the first nine months of the financial year 2012, the total value of imports of PVC systems stood on a slight downward trend and has decreased by less than 2% compared to 2011. Thus, the analyzed market appear to have stabilized somehow, yet at a very low rate. Also, the prospect of recovery is still quite far away, and even if resettlement opportunities in the local economy recession are low, a possible recovery process will take place after the revival of the construction segment, which in fact, has not yet begun. Taking into account that the local production can be estimated at a level of about 30% of all systems used to manufacture PVC windows (most important competitors holding extrusion units in Romania are represented by Gealan, Teraplast Extruplast and Ramplast), a simple estimation indicates that the local market value of PVC profiles is placed between 105 million Euro and 110 million Euro. This means that the total value of finished products (windows and doors) sold locally is estimated between 320 million Euro and 340 million Euro. All the data presented confirm the trend of stagnation, which can be interpreted in two different ways: one positive (given by the end of the decline phase) and one negative (consisting of the inability to resume growth in a hostile business environment, characterized by lack of financial resources). For further information and a detailed analysis of the current Fereastra issue, click here!Vizualizaţi acum şi valorificaţi toate oportunităţile!

Ştiri de calitate și informaţii de afaceri pentru piaţa de construcţii, instalaţii, tâmplărie şi domeniile conexe. Articolele publicate includ:

- Ştiri de actualitate, legislaţie, informaţii statistice, tendinţe şi analize tematice;

- Informaţii despre noi investiţii, lucrări, licitaţii şi şantiere;

- Declaraţii şi comentarii ale principalilor factori de decizie /formatori de opinie;

- Sinteza unor studii de piaţă realizate de către organizaţii abilitate;

- Date despre noile produse şi tehnologii lansate pe piaţă.

Ştiri de calitate și informaţii de afaceri pentru piaţa de construcţii, instalaţii, tâmplărie şi domeniile conexe. Articolele publicate includ:

- Ştiri de actualitate, legislaţie, informaţii statistice, tendinţe şi analize tematice;

- Informaţii despre noi investiţii, lucrări, licitaţii şi şantiere;

- Declaraţii şi comentarii ale principalilor factori de decizie /formatori de opinie;

- Sinteza unor studii de piaţă realizate de către organizaţii abilitate;

- Date despre noile produse şi tehnologii lansate pe piaţă.